Discover the latest real estate market trends in Kenya 2025. Learn price movements, rental yields, top neighbourhoods, financing options, and actionable steps for investors, buyers, and sellers in Kenya’s property market.

Kenya Real Estate Market Overview 2025

Market Growth Snapshot & Sector Expansion

The real estate market in Kenya 2025 is showing resilience, with growth projected at about 5–6% this year. Demand is rising in both the affordable and mid-tier housing sectors, driven by government housing programs and private developers. Diaspora buyers are also fueling apartment sales, especially in Nairobi and Kiambu. Infrastructure developments, such as new expressways, are helping suburban areas expand, giving buyers more options outside the city centre.

Capital Growth and Price Index Trends (HASS, Knight Frank)

According to the HASS Property Index, prime properties recorded a 7.8% price rise year to June 2025. Knight Frank’s H1 2025 report also highlights stronger gains in Nairobi suburbs, such as Westlands and Kilimani. These figures show that buyers who enter the market now stand to benefit from appreciation and higher rental returns. For sellers, it is a favourable time to list, with active demand holding up values.

Related post: What Kind of Apartment Can I Build with Kshs 70M in Isinya?

Supply vs Demand Balance (Housing Deficit & Completions)

Kenya faces a persistent housing deficit estimated at over 200,000 units per year. While many new projects are announced, completions often lag behind demand, especially in urban centres. This gap continues to support firm prices in cities like Nairobi, Mombasa, and Nakuru. Investors who target high-demand affordable housing or rentals are well-positioned to benefit from this imbalance.

Related post: How to Maximize Rental Income from Apartments in Nairobi (2025 Guide)

Residential Property Price Trends & Rental Yields

Prime vs Affordable Housing Performance

Prime suburbs such as Karen, Runda, and Lavington have seen stable growth, mainly attracting high-net-worth buyers. Affordable housing, however, is experiencing stronger demand, with projects in Nairobi, Kiambu, and Athi River absorbing quickly. Prime homes offer long-term capital appreciation, but affordable homes tend to deliver higher rental demand. This creates different strategies for investors depending on their risk and capital levels.

Rental Yields in Nairobi, Mombasa, Kisumu, Nakuru

Rental yields remain one of the strongest reasons to invest in Kenyan property. Nairobi averages between 6% and 8%, with hotspots like Kilimani and Westlands delivering even higher returns. Mombasa ranges between 5–6%, particularly for coastal properties that target tourists. Kisumu and Nakuru are catching up fast, with yields between 6–8%, driven by growing populations and increased urban activity.

Related post: What Apartment Can You Build with Ksh 40 Million in Syokimau? Units, Rental Income & ROI Explained

Suburban vs Inner-City Buyer Preferences

Buyer demand is gradually shifting toward suburban areas, such as Kiambu, Syokimau, and Athi River, where larger homes and better value can be found. Improved road networks and commuting options are making these suburbs more attractive for families and first-time buyers. Inner-city neighbourhoods such as Kilimani and Kileleshwa remain strong rental zones due to proximity to offices, schools, and social amenities. Investors need to weigh capital gains in suburban plots against steady rental demand in the city.

Related post: The Impact of Inflation on Property Prices in Kenya

High-Growth Neighbourhoods & Cities to Watch

Nairobi Micro-Markets — Westlands, Kilimani, Kileleshwa, Lavington

Nairobi’s key suburbs continue to attract both buyers and investors. Westlands offers strong rental demand from young professionals working in finance and tech. Kilimani maintains steady apartment sales driven by expats and middle-income earners. Kileleshwa is changing fast, with rezoning leading to affordable apartment blocks. Meanwhile, Lavington remains a luxury hub with high resale values for detached homes.

Secondary City Hotspots — Kiambu, Kajiado, Mombasa, Nakuru

Growth outside Nairobi is shaping the wider property market. Kiambu benefits from strong diaspora demand and affordable apartments. Kajiado attracts land buyers due to new expressways and proximity to Nairobi. Mombasa continues to offer opportunities in coastal rentals and tourism-driven homes. Nakuru is booming with mixed-use projects and growing investor confidence, making it one of the fastest-rising cities.

Infrastructure Impact — SGR, Expressways, Bypasses

Major infrastructure projects are pushing up land values and shaping buyer decisions. The Standard Gauge Railway (SGR) extension is driving demand in Mombasa and Naivasha. The Nairobi Expressway is boosting prices in Syokimau, Mlolongo, and Athi River. The Northern Bypass has unlocked growth opportunities in the Kiambu and Thika Road corridors. These projects make infrastructure-linked investments a smart play in 2025.

Commercial & Industrial Property Outlook

Office Market Demand and Vacancy Trends

Nairobi’s office market in 2025 is still stabilising after years of oversupply. Vacancy rates in Grade A offices remain around 20–25%, with tenants negotiating flexible leases. Demand is strongest from multinationals in Westlands and Upper Hill, while smaller firms are shifting to co-working spaces. Investors are cautious, but value exists in prime, well-located towers with high occupancy levels.

Warehousing, Logistics, and Industrial Parks

E-commerce growth and regional trade are driving demand for warehousing and logistics hubs. Modern industrial parks along the Eastern Bypass and in Athi River are recording strong uptake. Investors are increasingly shifting capital here, as logistics yields can outperform traditional office spaces. Developers partnering with global firms are leading the charge, creating high-standard facilities.

Retail Sector and Mixed-Use Developments

Kenya’s retail property market is rebounding, with malls in Nairobi, Mombasa, and Nakuru seeing foot traffic rise. Mixed-use projects like Two Rivers and Garden City are proving more resilient as they blend residential, retail, and entertainment spaces. Smaller community malls are also thriving in growing suburbs. Retail remains a competitive but promising sector if developers focus on consumer-driven design.

Related post: Affordable Housing Projects in Kenya – Opportunities & How to Benefit

Macro-Economic & Policy Drivers Affecting the 2025 Market

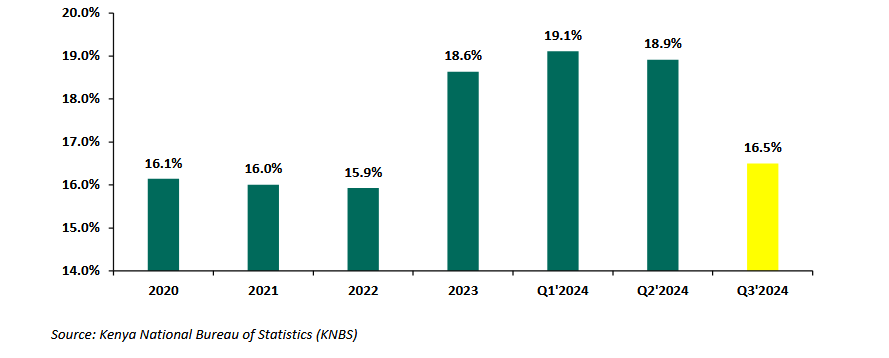

Interest Rates, Inflation, and Mortgage Availability

High interest rates remain a challenge in 2025, with mortgages averaging between 13% and 15%. Inflation pressures are softening, but borrowing remains costly for many households. Developers are therefore targeting cash buyers and SACCO-backed clients. Improved mortgage products are needed for broader affordability and increased uptake.

Government Affordable Housing Program & PPPs

The government’s Affordable Housing Program continues to shape Kenya’s property market. Public-private partnerships (PPPs) are delivering units in Nairobi, Kiambu, and Machakos. These projects target low- to middle-income earners, helping reduce the housing deficit. For investors, partnerships with state-backed projects offer security and scale.

Tax and Regulatory Updates (Stamp Duty, CGT, VAT)

Policy changes in stamp duty, capital gains tax (CGT), and VAT directly affect buyers and developers. The government has introduced targeted exemptions for first-time buyers in affordable projects. Developers in mixed-use and affordable housing benefit from reduced VAT rates. Staying compliant with these tax updates is key to avoiding costly delays.

Transactional Playbook for Buyers & Investors

ROI Checklist — CAPEX, Rental Income, Taxes, Vacancy

Smart investors in 2025 follow a disciplined ROI checklist. Key factors include capital expenditure, projected rental income, applicable taxes, and expected vacancy rates. This ensures a clear picture of profitability before purchase. Tools like property ROI calculators are increasingly popular for making these assessments.

Off-Plan vs Completed Units — Due Diligence Steps

Off-plan units often offer lower entry prices, but due diligence is critical. Buyers should verify developer track records, approvals, and escrow protections before committing. Completed units provide immediate rental returns but usually cost more upfront. Both approaches can work if risk is carefully managed.

REITs & Fractional Ownership as Alternative Investments

Real Estate Investment Trusts (REITs) and fractional ownership platforms are gaining ground in Kenya. They allow smaller investors to pool resources and access prime properties with less capital. Yields may be lower than direct ownership but come with lower risks and higher liquidity. These alternatives are attractive for diaspora and first-time investors.

Financing & Mortgage Options in Kenya 2025

Mortgage Rates, Requirements, and Application Process

Kenya’s mortgage market remains underdeveloped, with less than 30,000 active mortgages. Rates in 2025 average 13–15%, though some banks offer preferential terms for diaspora clients. Applicants must meet strict credit, income, and collateral requirements. Approval times can stretch, making preparation essential.

Deposit Amounts, LTV Ratios, and Required Documents

Buyers typically need deposits of 10–20% of the property value. Loan-to-value (LTV) ratios vary, but most lenders offer up to 80% for qualifying clients. Standard documentation includes payslips, bank statements, title deeds, and valuation reports. Meeting these requirements early smooths the application process.

Alternative Financing — SACCOs, Developer Credit, Diaspora Funding

SACCOs remain a leading financing channel, offering lower rates and flexible terms. Developers are also providing credit directly to buyers, with structured payment plans. Diaspora remittances continue to play a massive role, with specialised loan products for Kenyans abroad. These alternatives offer flexibility where traditional mortgages fall short.

Related post: Kenya Real Estate Market Trends 2025

Property Due Diligence & Closing Checklist

Land Searches via Ardhisasa & eCitizen

Before buying property in Kenya, a land search is mandatory. Platforms like Ardhisasa and eCitizen allow buyers to verify ownership and confirm if a title has encumbrances. This step reduces the risk of buying disputed or government land. Always request an official search certificate to secure your deal.

Title Verification, Survey & Building Approvals

A clean title deed is key to safe investment. Buyers should cross-check with the Ministry of Lands and ensure surveys match plot boundaries. If purchasing a house, confirm building approvals from the county government. This helps avoid demolition risks tied to illegal developments.

Taxes and Fees — Stamp Duty, VAT, Legal Fees, CGT

Buying property involves more than the purchase price. Key costs include stamp duty (2–4%), VAT on commercial properties, legal fees, and valuation charges. Sellers must also account for capital gains tax (CGT). Planning for these costs avoids unexpected budget shortfalls.

Fraud Risks & Red Flags to Avoid in Kenya

Fraud is a real risk in Kenya’s property market. Fake titles, double sales, and forged signatures are common scams. Always work with licensed advocates, verify all documents, and avoid rushed cash deals. If something feels too good to be true, it likely is.

Risks, Opportunities & Exit Strategies

Key Risks — Liquidity, Inflation, Developer Insolvency

Real estate is not always easy to liquidate quickly. High inflation can erode rental returns, while stalled developer projects expose buyers to losses. Investors must factor in these risks when planning. Diversifying across property types reduces exposure.

Growth Opportunities — Rental Income, Land Banking, Short-Term Lets

Despite risks, Kenya’s property market still holds strong opportunities. Rental income from student housing, serviced apartments, and affordable units is growing. Land banking in counties along new highways promises long-term capital gains. Short-term Airbnb-style lets also thrive in tourist-heavy areas.

Exit Strategies — Resale, Refinancing, REIT Exits

Smart investors plan exit strategies early. Reselling in high-demand areas offers capital gains, while refinancing unlocks equity for new projects. For hands-off investors, exiting through REITs or fractional ownership markets provides liquidity. Each option depends on the investor’s timeline and risk appetite.

Conclusion + CTA

Recap of Key 2025 Trends & Investor Opportunities

The real estate market trends in Kenya 2025 point to steady growth, fueled by infrastructure, affordable housing, and diaspora remittances. While risks remain, informed investors can capture value in both urban and suburban markets. Rental yields, land appreciation, and mixed-use developments are leading the way.

Action Step — Download Closing Checklist / Request ROI Calculator

If you’re planning to invest this year, start with a due diligence checklist and ROI calculator. These tools ensure you make profitable, risk-aware decisions. Take action today to secure opportunities before prices climb further in 2025.

Related post: Why Invest in Kenyan Real Estate Today

Frequently Asked Questions (FAQ)

- What are the real estate market trends in Kenya in 2025?

The real estate market in Kenya in 2025 is expected to grow by 5–6%. Affordable housing, rental income opportunities, and infrastructure-led expansion are driving demand across Nairobi, Kiambu, Nakuru, and coastal cities.

- Which areas in Kenya are best for property investment in 2025?

Top-performing areas include Nairobi suburbs like Kilimani, Westlands, and Kileleshwa, as well as secondary cities like Kiambu, Kajiado, Nakuru, and Mombasa. Infrastructure projects such as the expressway and SGR are boosting land and housing values.

- What is the average rental yield in Kenya in 2025?

Rental yields range from 5–8% depending on location and property type. Nairobi averages 6–8%, Nakuru 7–8%, while coastal cities like Mombasa record 5–6%, with beachfront rentals performing slightly better.

- Is it better to buy off-plan or a completed property in Kenya?

Off-plan properties are cheaper but carry more risk if the developer stalls. Completed units are safer and provide immediate rental returns, but cost more upfront. Investors should weigh risk tolerance and due diligence carefully.

- What risks should investors watch out for in Kenya’s property market?

Key risks include liquidity challenges, inflation, and cases of developer insolvency. Fraud, fake titles, and double land sales are also common risks, making due diligence essential.

- How can I finance property purchases in Kenya in 2025?

Financing options include bank mortgages, SACCO loans, diaspora financing, and developer credit schemes. Mortgages average 13–15% interest, while SACCOs often offer lower and more flexible rates.

- What are the extra costs of buying property in Kenya?

Besides the purchase price, buyers should budget for stamp duty (2–4%), legal fees, valuation charges, and possible VAT on commercial units. Sellers also pay capital gains tax (CGT).

- How do I verify land ownership before buying in Kenya?

Use the Ardhisasa or eCitizen platforms to run an official land search. This confirms the rightful owner, title status, and whether the property has encumbrances or disputes.

30 thoughts on “Real Estate Market Trends in Kenya 2025 — What Buyers, Investors & Sellers Must Know”