Affordable housing demand in Kenya

Explore the unmet demand for affordable housing in Kenya, understand how the housing shortage in Nairobi limits supply, and discover investor-ready product types, financing solutions and developer checklists to capitalise on this growth opportunity.

Introduction

Kenya is experiencing a swelling wave of affordable housing demand in Kenya as urbanisation, population growth and income segmentation create an urgent need for low-cost homes. With estimates of about 250,000 new units required annually and supply lagging far behind, the gap offers both a social imperative and a commercial opportunity. This article walks through the market size, supply dynamics, specific pressure in Nairobi, key barriers, and how buyers, developers and investors can engage. You’ll also find practical checklists, product model ideas and step-by-step conversion tools to act on now.

Current market size and demand drivers in Kenya

Kenya’s housing need is large and growing, driven by rapid urbanisation and changing household composition. Understanding these demand drivers is critical if you’re looking at how to invest in affordable housing Kenya or build products that meet real demand.

Urbanisation, population growth and household formation

Kenya’s population is expected to exceed 52 million by the end of 2024, adding large numbers to urban centres at about 4.4% per year. As more people move to cities and form new households, the demand for affordable housing units increases sharply. The fact that the annual requirement is estimated at roughly 250,000 units underpins the scale of the need.

Income segmentation and affordability bands

Not all housing demand is the same — different income groups require different products. For example, homes aimed at those earning under Kshs 20,000/month (social housing), between Kshs 20,000-149,000/month (affordable housing) and above that for the so-called “affordable market” segment. Designing product types with income bands in mind is a smart strategy when focusing on low-cost housing construction cost per unit Kenya 2025 planning.

Demand by tenure: rent, purchase, rent-to-own

While buying is a goal for many, rental and rent-to-own models are increasingly relevant. Many Kenyans cannot immediately afford large deposits or full mortgages, so alternative models like rent-to-own homes Nairobi process and costs are gaining traction. Developers and investors need to recognise this shift and model units accordingly.

Supply-side picture: housing supply Kenya

While demand is huge, supply in Kenya is falling well short, especially in the affordable and low-income segments. This section explores the supply landscape, government programmes, private delivery and the invisible informal housing sphere.

Public programmes: AHP, NHC, county-level projects

The government’s Affordable Housing Programme (AHP) aims to fill the gap but results have been mixed. According to one review, current supply is about 50,000 units annually vs. demand of around 250,000. The provision is aimed at income bands and includes tax incentives like stamp duty removal for first-time buyers in affordable housing schemes.

Private sector delivery: product mix, unit sizes, price bands

Most private development activity tends to focus on mid- and high-end products rather than the low-cost/mass-market segment. The consequence is that the lower end of the market remains underserved. As you plan how to build affordably, understanding what unit sizes and price bands sell quickly is key.

Informal housing and slum tenure: a hidden supply factor

About 46.5% of urban Kenyans live in slums or informal settlements according to CAHF. These homes satisfy some part of demand though they are largely unplanned and lack infrastructure. Recognising this hidden supply is crucial when planning formal affordable housing developments.

Nairobi hotspot analysis: housing shortage Nairobi

The capital city region presents both one of the greatest pressure points and opportunity zones for affordable housing. Identifying micro-markets, infrastructure gaps and informal settlement dynamics is critical if you want to tap the opportunity.

Metro micro-markets: commuter belts and demand density

In locations just outside Nairobi’s core — such as commuter belts — demand for affordable housing is high because people want access to the city but cannot afford inner-city prices. Knowing which wards or suburbs offer land and transport access can deliver margin. For example, neighbourhoods such as Mihang’o are growing low- to middle-income zones.

Infrastructure constraints, transport links and affordability

Affordable housing supply often fails because infrastructure (roads, water, sewerage) is missing. In Nairobi, units delivered in low-infrastructure zones require higher allowances for service costs and risk slower absorption. Properly positioned housing near transit links will command better uptake.

Informal settlements and upgrading opportunities

Informal communities such as slums are heavily present in Nairobi, and upgrading or in-situ redevelopment offers a route to supply affordable housing. For example approximately 70% of Nairobi’s residents live in informal settlements. By partnering with the government, developers can tap site-and-service or PPP models to convert informal tenure into formal affordable units.

Regulatory, land & planning barriers that limit supply

Even when demand and supply dynamics align, a range of structural barriers prevents the flow of affordable housing. For those looking to invest or build low-cost housing, these are the pitfalls to plan for and avoid.

Land costs, fragmentation, titles and leasehold vs freehold implications

Land in and around Kenya’s cities is the single largest cost driver. Fragmented land holdings, unclear titles and leasehold regimes increase risk and cost. Efficient acquisition and legal clarity are vital prerequisites for viable low-cost housing. Studies highlight land costs as a major supply bottleneck.

Zoning, permissible densities, approvals timeline and costs

Regulatory approvals in many Kenyan counties remain slow and costly. Lower densities mean higher cost per unit, which undermines affordability. Developers need to engage early on zoning changes, higher-density allowances and fast-track approval processes. This is a critical barrier to meeting the demand for affordable housing in Kenya.

County-level planning differences and where to fast-track approvals

Each of Kenya’s 47 counties has its own planning regime. Some counties are more developer-friendly than others. By identifying counties with streamlined planning or incentives, developers can shorten time-to-market and reduce risk.

Financing & fiscal barriers (buyers and developers)

Financing remains a core challenge both for home-buyers and for developers at the affordable housing end. If you’re looking at how to invest in affordable housing Kenya, the financing model is as important as the product.

Mortgages, KMRC, microfinance and deposit requirements

Access to long-term home loans is limited in Kenya. For example, the Kenya Mortgage Refinance Company (KMRC) was set up to increase affordable home-finance options, but as yet uptake is low. Many buyers simply cannot meet deposit or income requirements, limiting purchase volume.

Developer finance: project loans, escrow, offtake guarantees and bridge loans

Developers often struggle to access affordable project finance for low-cost housing because margins are thin and risk perceived high. The absence of offtake guarantees or long-term financing raises cost of capital and delays delivery.

Housing levy, tax incentives and unlocking funds for projects

In 2024 Kenya introduced an Affordable Housing Act and housing levy to mobilise funds for affordable housing. Understanding how to align a project with these funding streams can reduce finance cost or enhance viability.

Construction, materials and cost control (practical builder guidance)

Controlling construction cost per unit is one of the most effective ways to achieve low-cost housing while maintaining commercial viability. This section outlines practical tactics for low-cost housing construction cost per unit Kenya 2025.

Typical cost drivers: labour, cement/steel, transport, imports

In Kenya, cost pressures come from high cement and steel prices, inefficient labour deployment and long transport routes for materials. Awareness of these cost drivers allows developers to focus on cost-mitigation from the start.

Cost-saving methods: alternative materials, modular/precast, site optimisation

Some successful projects have used modular or precast construction, alternative local materials and optimised site layout to reduce unit cost substantially. These methods support profitable models in the lower-cost segment.

Quality and durability checks — what to monitor to avoid re-works

Lower cost must not mean poor quality. Re-works from defects undermine affordability and reputation. Include checklists for structural integrity, finishes and service delivery to avoid hidden cost overruns.

Viable product types & business models (transactional – convert readers)

With the demand-supply gap established and barriers framed, we can explore the product types and business models that deliver in the affordable space. Whether you are a buyer, small developer or investor, knowing which product and model to pursue matters.

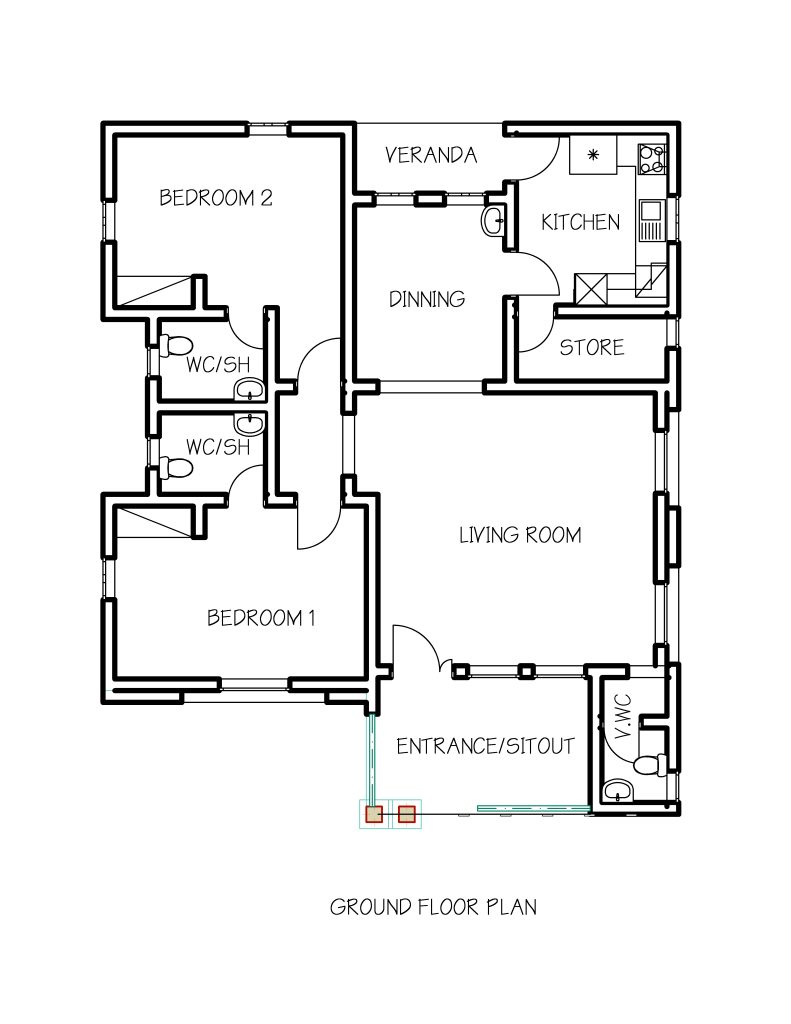

Unit types that convert quickly: bedsitters, studio clusters, 1-2 bed units

In Kenya’s affordable housing segment, smaller units – for example bedsitters or studio clusters – tend to absorb faster because they align with the income profile of many buyers or renters. When analysing how to invest in affordable housing Kenya, focusing on high-turnover unit types makes sense.

Business models: affordable rental, rent-to-own, co-operative housing, PPP

Beyond sale-units, models like affordable rental, rent-to-own homes in Nairobi process and costs, housing co-operatives and PPP (public-private partnership) delivery can deliver returns and affordability simultaneously. These models help unlock demand when buyers cannot access full mortgages.

Pricing & unit mix suggestions by county/Nairobi submarket

Carefully structuring pricing and unit-mix across counties or Nairobi submarkets can enhance absorption rates and reduce risk. For example, selling a mix of 30% bedsitters, 50% 1-bed and 20% 2-bed units in commuter zones may deliver faster uptake and stable rental demand.

Investment economics: returns, sensitivity & example pro forma

For investors and developers, understanding the return metrics on affordable housing is essential. This section gives you the numbers and sensitivity logic you need to evaluate projects in the affordable space.

Simple pro-forma example (assumptions, revenue, costs, IRR)

A simplified pro-forma might assume 100 units of 1-bed at Kshs 4 million each, cost per unit Kshs 3.2 million, selling over 24 months with 10% developer margin. Running the numbers yields an internal rate of return (IRR) in the range of 16-20% depending on speed of sale and cost escalation.

Sensitivity tests: cost over-runs, price compression, absorption slowdown

Even affordable housing demand in Kenya is not immune to risk. Consider scenarios: a 10% cost overrun, a 5% drop in price, or a 6-month delay in sales — each will reduce IRR. Use these sensitivity tests when modelling possible returns and determine whether you have buffers.

Key KPIs: units delivered/year, cost/unit, absorption rate

Track metrics such as units delivered per annum, cost per unit, months to first sale, vacancy or absorption rate and developer margin. These KPIs are vital to compare projects and identify the ones that meet the target of affordable housing demand in Kenya.

Conclusion

Meeting the affordable housing demand in Kenya is one of the largest commercial and social opportunities in the country today. With an annual shortfall of hundreds of thousands of units, particularly in the Nairobi metro, developers, investors and home-buyers who understand the dynamics can win. Whether you’re looking to build homes, rent them, invest in a rent-to-own model or simply purchase a low-cost unit, aligning with the right unit types, financing models, cost control measures and market segment is critical. If you act now you position yourself ahead of the curve in capturing demand and delivering homes, while generating returns and contributing to Kenya’s housing transformation.