Real Estate Journalism Kenya

Explore the future of Real Estate Journalism in Kenya. Discover emerging housing trends, industry insights, property analysis, and the tools shaping media coverage. Stay ahead in the evolving Kenyan property market.

Introduction

Real Estate Journalism Kenya

Real estate journalism in Kenya is evolving rapidly, driven by technology, data analytics, and changing consumer behavior. Today, journalists are no longer just reporting property listings—they provide in-depth industry insights, analyse housing trends, and deliver actionable property analysis that helps investors, homeowners, and developers make informed decisions.

The rise of digital platforms and PropTech tools has made real estate news more interactive, engaging, and accessible. Mobile-first reporting, virtual tours, and data-driven articles are now shaping how Kenyans consume property information.

This article will explore the future of real estate journalism Kenya, highlighting the trends transforming reporting, key services offered, cost factors, legal considerations, and how to choose the right service. Along the way, we’ll provide practical examples, internal links to related guides, and tips for staying ahead in the evolving property media landscape.

Why Real Estate Journalism Matters in Kenya

The Role of Real Estate Journalism in Shaping Investor Decisions

Estate Journalism Kenya

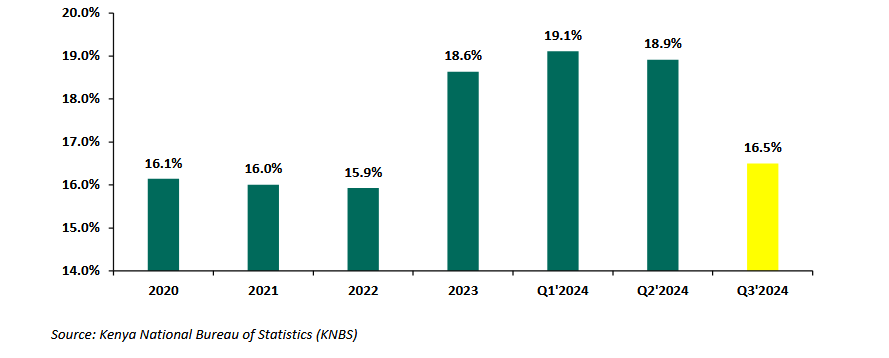

Real estate journalism in Kenya plays a critical role in guiding investor decisions. By providing detailed property market reporting in Kenya, journalists help investors understand market fluctuations, emerging neighborhoods, and profitable investment opportunities. Accurate reporting reduces risks and ensures that both local and international investors make informed choices.

Impact on Housing Trends and Policy Awareness

Journalists reporting on real estate influence housing trends by highlighting shifts in supply, demand, and affordability. Coverage of government policies, zoning regulations, and new housing initiatives ensures that developers, homeowners, and investors remain informed. This kind of reporting also encourages transparency in the property market.

Educating Homebuyers and Renters on Market Dynamics

Beyond investors, real estate journalism educates homebuyers and renters about market dynamics. Articles covering price trends, neighborhood developments, and rental patterns equip individuals to make smart decisions. Through consistent reporting, the public gains access to industry insights that were previously difficult to obtain.

Services Included in Real Estate Reporting

Market Reports and Investment Insights

Real estate journalism services in Kenya often include market reports that summarise property prices, rental yields, and investment hotspots. These reports provide both short-term snapshots and long-term projections, allowing investors to plan strategically and stay ahead of market changes.

Property Analysis & Housing Trend Reports

Comprehensive reporting includes housing trend analysis and property performance studies. Journalists examine neighbourhood growth, infrastructure projects, and buyer behavior, producing insights that are essential for developers, investors, and policy planners.

Multimedia Storytelling: Videos, Virtual Tours, Infographics

Modern real estate journalism leverages multimedia tools to make content more engaging. Virtual tours, videos, and infographics provide interactive ways for readers to explore properties, understand market data, and visualise trends. These tools are especially useful for digital audiences consuming real estate content on mobile devices.

Keyword Opportunities Used: Real estate media coverage Kenya housing trends, industry insights Kenya property

Cost Breakdown of Real Estate Journalism Services

Subscription & Premium Content Pricing

Many real estate journalism platforms in Kenya offer subscription-based access to premium content. Subscribers gain full access to in-depth property analysis services, detailed market reports, and exclusive investment insights. Pricing varies depending on the depth of content, frequency of updates, and additional tools such as interactive dashboards. This model ensures consistent revenue for journalists while providing value to serious investors.

Sponsored Content and Affiliate Partnerships

Another revenue stream comes from sponsored content and affiliate partnerships. Real estate media outlets often collaborate with developers, agencies, or financial service providers to publish articles, market insights, or property listings. These partnerships provide additional funding but require clear labeling to maintain transparency and credibility. Properly managed, sponsored content can enhance readers’ access to market opportunities without compromising journalistic integrity.

Data Analytics & Research Fees

High-quality real estate journalism relies on accurate data analytics and research. Some services charge fees for custom reports, predictive analytics, or specialised property market studies. These fees cover data collection, validation, and visualisation, ensuring that reports are reliable and actionable. Investors and developers who value detailed insights often consider these fees a worthwhile investment.

Factors Influencing Costs

Depth of Reporting and Analysis

The depth of reporting is a major factor influencing the cost of real estate journalism services in Kenya. Comprehensive articles that analyse multiple neighbourhoods, include price trends, and forecast market movements require more time and expertise, which increases the service cost. Readers and investors benefit from detailed analysis as it enables informed decisions.

Platform Type: Online, Print, or Hybrid

The platform used for delivering real estate journalism also affects pricing. Online-only services are generally more cost-effective, while hybrid models combining print and digital reach broader audiences but incur higher production costs. Choosing the right platform depends on the target audience, whether it’s investors, homeowners, or industry professionals.

Frequency of Updates and Real-Time Reporting

Real-time reporting and frequent content updates require more resources and specialised tools. Services offering daily or hourly market updates, live property news, or instant investment alerts charge higher fees due to the continuous effort involved. Investors and developers often prioritise these services for timely decision-making.

Legal & Regulatory Considerations

Compliance with Kenyan Media Laws

Real estate journalism in Kenya must adhere to local media laws and regulations. Compliance ensures that reporting is legal, credible, and protects both journalists and readers from misinformation or legal repercussions. Articles covering property markets, housing policies, or investment opportunities need to respect copyright rules, fair reporting standards, and data privacy requirements. Following these regulations strengthens public trust in Kenyan real estate media.

Ethical Standards in Property Reporting

Ethical journalism is essential in the property sector to maintain accuracy and integrity. Reporters must avoid biased reporting, disclose conflicts of interest, and clearly label sponsored content or partnerships. Upholding ethical standards ensures that property analysis and industry insights are reliable and credible, helping readers and investors make informed decisions without being misled.

Handling Misinformation and Source Verification

A key challenge in real estate journalism is combating misinformation and ensuring source verification. Journalists should confirm property details, cross-check data from developers, government agencies, and market databases, and provide accurate references. Verified reporting builds confidence among homeowners, investors, and stakeholders while reducing the risk of legal or reputational issues.

How to Choose the Right Real Estate Journalism Service

Assessing Expertise in Housing

Trends and Property Analysis

When selecting a real estate journalism service in Kenya, it’s important to evaluate the team’s expertise. Services should demonstrate deep knowledge of housing trends, property prices, and market dynamics. Look for platforms that provide detailed analysis, backed by credible data and a history of accurate reporting. Experienced journalists ensure insights are actionable for both investors and homeowners.

Evaluating Multimedia and Data Capabilities

Modern property journalism increasingly relies on multimedia and data visualisation. Platforms offering videos, virtual tours, interactive dashboards, and infographics enhance the reader experience and make complex property data easier to understand. Choosing a service with strong digital capabilities ensures more engaging and informative content for both casual readers and serious investors.

Reviews, Case Studies, and Credibility

Assessing past performance is essential when selecting a journalism service. Look for client reviews, case studies, and examples of successful reporting that influenced market decisions. Credibility and transparency in service delivery are strong indicators of the quality of insights you can expect. Verified testimonials and independent evaluations provide additional confidence when choosing a platform.

Conclusion

Real estate journalism Kenya is evolving rapidly, driven by technology, data analytics, and growing demand for actionable property analysis. Investors, homeowners, and industry professionals benefit from accurate market reports, multimedia storytelling, and insights into housing trends.

To stay ahead in the Kenyan property market:

- Subscribe to newsletters for real-time property news.

- Follow reputable property blogs and investment guides.

- Explore multimedia reports and infographics for deeper market understanding.

Snippets & Image Packs: Consolidate charts, infographics, and visual summaries here for SEO and social sharing. These visual tools improve engagement and make complex data easy to understand.