Student Housing Market Trends 2026

Explore Student Housing Market Trends for 2026, including PBSA growth, rising student accommodation demand, rental pricing, investor opportunities, and regional forecasts.

Introduction

Student Housing Market Trends 2026

The Student Housing Market Trends are evolving rapidly in 2026, driven by increasing international student mobility, rising enrollment rates, and growing demand for Purpose Built Student Housing (PBSA).

Urban areas and university towns are experiencing a surge in demand for modern, amenity-rich student housing. Shortages in supply are pushing rental prices higher, making it essential for stakeholders to understand where growth is occurring and how to position their properties effectively.

The following article will explore key student housing market trends, highlight the growth of PBSA, analyse student accommodation demand by region, and provide insights into the student rental market trends.

Student Housing Market: Overview & Market Size

The student housing market trends are showing strong growth globally, with both investors and universities focusing on student accommodation demand and the rise of Purpose Built Student Housing (PBSA). Understanding the market size and forecast is key for making informed investment decisions.

Global Market Growth & Forecasts

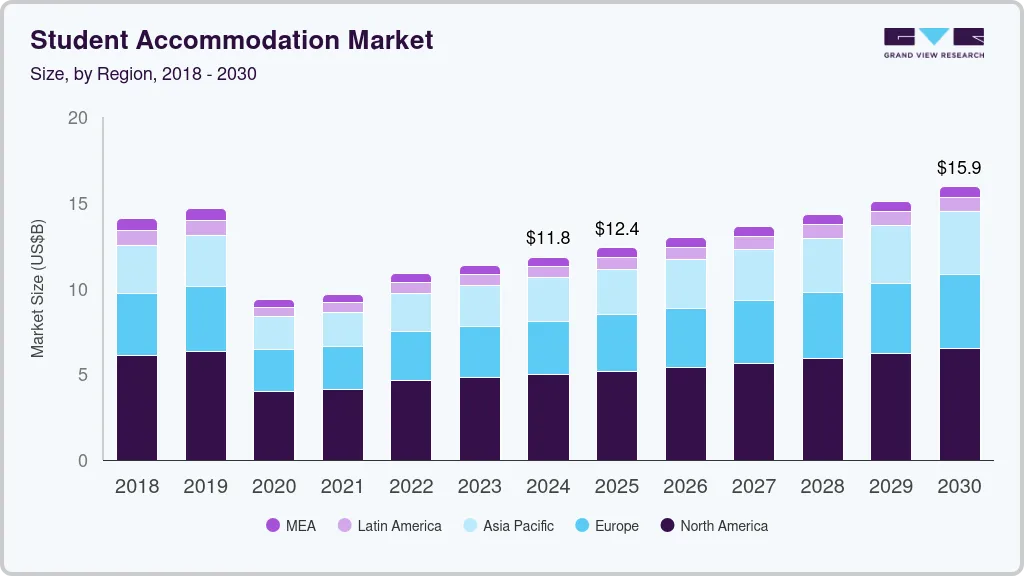

The global student housing market has expanded significantly over the past decade. Analysts project continuous growth through 2035, with major contributions from North America, Europe, and Asia-Pacific regions.

- CAGR (compound annual growth rate) estimates range between 5–7% depending on the region.

- Urban centers with top universities see the highest occupancy rates.

- Emerging markets, such as Africa, are becoming hotspots for student housing development.

Key Demand Drivers

Several factors are driving the growing student accommodation demand:

- Increasing international student mobility

- Rising university enrollment rates worldwide

- Shift toward modern, amenity-rich PBSA properties

- Preference for safe, well-connected locations

These drivers also influence student rental market trends, pushing investors to prioritise high-demand areas with limited supply.

Market Challenges

Despite growth, the student housing market faces several challenges:

- Limited supply of high-quality PBSA units in major cities

- Affordability pressures for students and families

- Regulatory and planning hurdles that slow construction

- Economic fluctuations affecting international student enrollment

Addressing these challenges is crucial for developers and investors seeking stable returns in the student rental market trends.

Evolving Student Accommodation Demand

The dynamics of student accommodation demand are changing as student preferences and living patterns evolve.

Traditional vs. Structured Housing Patterns

Student housing options generally fall into two categories:

- Traditional rentals (private apartments, HMOs, university dorms)

- Purpose Built Student Housing (PBSA) with modern amenities

Structured PBSA options are increasingly preferred due to better safety, community spaces, and integrated services. This trend directly affects student rental market trends in high-demand cities.

Student Preferences & Behavioral Shifts

Today’s students prioritise:

- High-speed internet and tech-enabled living

- Study spaces, gyms, and communal areas

- Flexible lease terms and furnished units

- Proximity to campus and public transport

These preferences are reshaping student housing market trends, especially in urban university towns. Understanding these behavioral shifts helps developers design attractive properties and maintain high occupancy rates.

Purpose Built Student Housing (PBSA): Growth & Features

Purpose Built Student Housing (PBSA) is one of the fastest-growing segments shaping student housing trends 2026. Developers are shifting toward PBSA because it offers predictable demand, stable rental income, and layouts designed specifically for modern students. This model is now preferred in major university cities due to its efficiency and long-term investment appeal.

Why PBSA Leads the Sector

PBSA leads the student housing sector because it is designed around student lifestyles rather than traditional rental models. These developments offer structured management, flexible lease terms, and consistent occupancy throughout the academic year. Investors also benefit from reduced vacancy risks compared to private rentals. The growing international student population and urban campus expansion continue to drive PBSA demand.

Amenities & Technology Trends in PBSA

Modern PBSA projects focus heavily on amenities and smart technology to attract tenants. Students now expect convenience, security, and digital connectivity as standard features. These expectations directly influence design and pricing strategies.

Common PBSA amenities include:

- High-speed Wi-Fi and smart access systems

- Shared study lounges and co-working spaces

- On-site gyms, cafés, and laundry facilities

Technology integration improves tenant satisfaction and reduces management costs. This aligns strongly with evolving student housing market trends.

Sustainability & Well-Being Features

Sustainability is now a key decision factor in PBSA development. Green buildings lower operational costs while appealing to environmentally conscious students. Developers are also prioritising mental health and wellness in design.

Popular sustainability and well-being features include:

- Energy-efficient lighting and water systems

- Natural lighting and ventilation

- Quiet study areas and outdoor relaxation spaces

These features enhance long-term asset value and support responsible development within student housing trends 2026.

Student Rental Market Trends & Rental Price Drivers

The student rental market is being shaped by affordability pressures, limited supply, and shifting enrolment patterns. Understanding these drivers helps investors and developers make informed pricing and planning decisions. These factors play a major role in defining student housing trends 2026.

Pricing Forecasts & Rent Inflation

Student rent prices are expected to rise steadily due to increased operating costs and strong demand. Inflation, maintenance expenses, and land prices continue to push rental rates upward. PBSA properties often command higher rents due to added amenities and security. Despite price growth, demand remains resilient in prime university locations. This balance supports sustainable rent increases across the student rental market.

Supply Shortages & Market Impact

Supply shortages remain a major challenge in many student cities. New developments are not keeping pace with rising enrolments, especially near major campuses. This imbalance drives competition and increases occupancy rates. Limited supply strengthens landlord pricing power while reducing tenant options. These conditions continue to influence student housing trends 2026 across global and regional markets.

Impact of Market Corrections

Market corrections can temporarily slow student housing growth, especially during economic uncertainty. However, student accommodation tends to recover faster than other real estate sectors. Education demand remains relatively stable even during downturns. Corrections often create opportunities for strategic acquisitions and long-term positioning. This resilience reinforces the importance of student housing within student housing trends 2026.

Investment Landscape & Risk Factors

The investment landscape for student housing trends 2026 is shaped by strong demand, institutional capital, and evolving risk profiles. Investors are increasingly targeting PBSA assets due to predictable cash flow and long-term resilience. However, careful risk assessment remains essential for sustainable returns.

PBSA Investment Trends & Deals

PBSA investment activity continues to grow as institutional investors expand their student housing portfolios. Large-scale acquisitions, joint ventures, and forward-funding deals are becoming more common in key university cities. These transactions reflect confidence in the long-term performance of student accommodation. Cross-border investments are also increasing as global funds seek diversification. This momentum reinforces PBSA’s role within student housing trends 2026.

Cash Flow & ROI Considerations

Cash flow stability is one of the main attractions of student housing investments. PBSA assets typically benefit from high occupancy rates and annual lease renewals. This structure supports consistent income and predictable returns.

ROI is influenced by location, operating efficiency, and amenity offerings. Investors who optimise management and tenant experience tend to outperform the wider student housing market.

Regulatory & Market Risks

Regulatory changes remain a key risk factor for student housing investors. Zoning laws, rent controls, and student visa policies can directly impact occupancy and pricing. Market risks such as oversupply in certain cities also require close monitoring. Understanding local regulations helps mitigate exposure and protect long-term value. Risk awareness is a critical component of student housing trends 2026.

Regional Market Insights & Case Studies

Regional performance varies widely across global student housing markets. Factors such as enrolment growth, affordability, and government policy influence demand patterns. These regional insights provide valuable context for student housing trends 2026.

Europe & UK Dynamics

Europe and the UK remain mature and competitive student housing markets. Strong international student inflows and limited urban land continue to support PBSA demand. Cities like London, Manchester, and Berlin attract consistent investor interest. Despite regulatory pressures, occupancy rates remain high. These conditions sustain long-term confidence in European student housing investment trends.

Asia-Pacific & Emerging Markets

The Asia-Pacific region is experiencing rapid growth in student housing demand. Rising university enrolments and expanding middle-class populations are key drivers. Countries such as Australia, China, and India are seeing increased PBSA development. Emerging markets offer higher growth potential but come with added risk. These dynamics make the region a focal point in student housing trends 2026.

Africa & South Africa Outlook

Africa’s student housing market is still underdeveloped but holds strong long-term potential. Growing youth populations and expanding higher education systems are driving unmet demand. South Africa leads the region with established PBSA projects and private investment. Infrastructure gaps and financing challenges remain key hurdles. Even so, Africa is increasingly recognised within global student housing trends 2026.

Conclusion

The outlook for student housing trends 2026 remains positive, supported by strong enrolment growth. This section summarises the key insights and highlights visual assets that enhance market understanding.

Summary of Key Market Trends

Student housing in 2026 is defined by rising demand, limited supply, and a shift toward purpose-built solutions. Sustainability, technology, and wellness features are now standard expectations. These trends continue to reshape global student accommodation markets.

Investment Opportunities Recap

PBSA remains the most attractive investment segment due to stable cash flow and resilient demand. Emerging markets offer growth potential, while mature regions provide income stability. Strategic location selection is critical for long-term success.