How Inflation Impacts Property Prices in Kenya

Explore how inflation is influencing property prices in Kenya in 2025. Understand the factors driving changes in real estate values and discover strategic insights for buyers and investors.

Introduction

How Inflation Impacts Property Prices in Kenya

In 2025, Kenya’s property market is evolving rapidly, and inflation is a key factor influencing housing prices across the country. Understanding how inflation and property prices in Kenya interact helps investors and buyers make informed decisions. With the economy facing rising costs in multiple sectors, knowing market trends can safeguard investments and guide purchasing strategies.

Understanding Inflation in Kenya

Inflation directly affects the affordability and demand for housing. Knowing the factors driving Kenya’s inflation helps buyers, investors, and developers anticipate changes in property prices and plan accordingly.

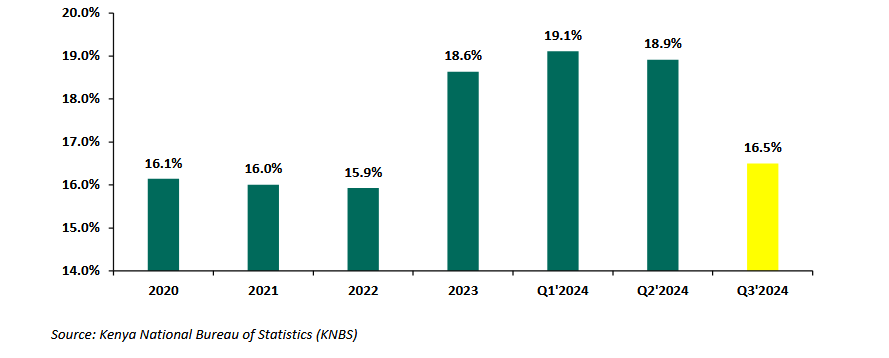

Current Inflation Trends

As of September 2025, Kenya’s annual inflation rate is 4.6%, slightly higher than the previous month. Key drivers include rising food and transport costs, increased housing expenses, and global commodity price fluctuations. The Central Bank of Kenya has adjusted the benchmark lending rate to 9.25% to stabilise the economy while supporting growth.

Factors Driving Inflation

Several factors contribute to inflation in Kenya:

- Supply Chain Disruptions: Global supply constraints have increased import costs.

- Rising Fuel Prices: Higher fuel costs impact transportation and construction expenses.

- Currency Depreciation: A weaker Kenyan Shilling makes imports more expensive.

- Demand Pressures: Economic recovery post-pandemic has increased demand for goods and services, including housing.

Inflation’s Impact on Consumer Behavior

Inflation affects how people spend and borrow:

- Reduced Disposable Income: Consumers have less money for non-essential purchases.

- Shift in Spending Priorities: Essentials are prioritised over luxury goods.

- Higher borrowing costs: Loans, including mortgages, become more expensive.

The Impact of Inflation on Property Prices

Inflation influences property prices in multiple ways, affecting both buyers and investors. Historical and current trends provide insight into what the future may hold.

Historical Perspective

Historically, periods of high inflation in Kenya coincided with notable increases in property prices. During the early 2000s, rapid inflation pushed construction costs higher, driving residential and commercial property values up. However, these periods often saw corrections afterward, showing that property prices respond dynamically to economic conditions.

Current Market Dynamics

In 2025, property prices in Kenya have risen by approximately 7.8%, outpacing inflation slightly. Contributing factors include:

- High Demand: Urbanisation and population growth increase housing needs.

- Investment inflows: Both local and foreign investors are boosting the market.

- Limited Supply: High construction costs and regulatory delays restrict new developments.

Regional Variations

Property price trends differ by region:

- Nairobi: Prices grow steadily in high-demand areas like Kilimani and Westlands.

- Coastal Areas: Mombasa sees seasonal fluctuations influenced by tourism.

- Rural Counties: Places like Kiambu and Machakos are emerging as attractive investment hubs due to affordability and proximity to Nairobi.

Sector-Specific Impacts

Different real estate sectors respond differently to inflation:

- Residential Properties: Generally see steady appreciation during inflationary periods.

- Commercial Properties: Office and retail spaces may experience slower growth due to higher operating costs.

- Land Investments: Undeveloped land often appreciates steadily, making it a safe hedge against inflation.

Real Estate Inflation in Kenya

Real estate inflation is the rate at which property prices increase, reflecting market demand, construction costs, and economic conditions. Tracking this helps investors and buyers make informed decisions.

Definition and Significance

Real estate inflation represents price growth in property over time. In Kenya, monitoring this metric is essential for evaluating potential returns on investment and predicting future market trends.

Key Indicators

Important metrics for real estate inflation include:

- Property Price Index: Measures average price changes across regions.

- Rental Yields: Indicates the return on rental investments.

- Construction Costs: Rising costs often lead to higher property prices.

Future Projections

Experts forecast moderate growth in real estate prices, influenced by:

- Economic Policies: Government measures to control inflation and stimulate growth.

- Global Economic Conditions: Trade and investment flows impact local real estate.

- Infrastructure Development: New roads, utilities, and urban expansion drive property value increases.

Housing Prices in Kenya: Current Trends

Kenya’s housing prices reflect the interplay between inflation, demand, and policy initiatives. Understanding these trends helps buyers and investors identify opportunities.

Urban vs. Rural Areas

Urban areas like Nairobi and Mombasa experience higher price growth due to limited space and high demand. Rural areas, however, offer affordable options for first-time buyers and investors seeking lower entry costs. Satellite towns like Athi River and Thika are seeing significant appreciation, offering value for early investors.

Affordable Housing Initiatives

The government has implemented measures to promote affordable housing:

- Public-Private Partnerships (PPP): Collaboration with private developers to build low-cost units.

- Subsidised Loans: Financial products making homeownership accessible.

- Regulatory Reforms: Streamlining approvals to encourage more construction.

Investment Opportunities

Despite inflationary pressures, several property segments remain lucrative:

- Middle-Income Housing: High demand in satellite towns offers strong growth potential.

- Commercial Properties: Offices and retail spaces in urban areas attract investors.

- Land Investments: Emerging counties provide opportunities for long-term capital appreciation.

Impact of Inflation on Housing Affordability

Inflation raises the cost of building materials, labour, and land, making homes less affordable. Buyers may need to adjust their budgets or consider alternative locations to find value for money.

Navigating the Market: Tips for Buyers and Investors

Understanding inflation and property price dynamics helps buyers and investors make sound decisions.

Strategies for Buyers

- Research Market Trends: Track property prices, rental yields, and inflation rates.

- Consider Long-Term Value: Focus on areas likely to appreciate in value.

- Evaluate Financing Options: Compare mortgage rates to secure favorable terms.

Investment Considerations

- Diversify Portfolio: Spread investments across property types and regions.

- Assess Risk Factors: Consider economic and political conditions affecting property markets.

- Monitor Regulatory Changes: Stay informed about new policies affecting real estate.

- Conduct Due Diligence: Verify titles and ownership.

- Engage Professionals: Use real estate agents, lawyers, and financial advisors.

- Plan for Contingencies: Maintain reserves for unexpected costs or market downturns.

Leveraging Financing Options

- Fixed-Rate Mortgages: Protect against rising interest rates.

- Government Subsidies: Explore programs that reduce homeownership costs.

- Private Loans: Consider flexible terms for strategic investments.

Economic Policies and Their Effect on Kenya’s Real Estate Market

Kenya’s economic policies play a crucial role in determining how the real estate market performs, especially during inflationary periods. Government actions such as adjusting interest rates, introducing tax incentives, and regulating land use directly shape property affordability and investor confidence. When inflation rises, the Central Bank often increases interest rates to stabilise the economy, which in turn affects borrowing costs for developers and buyers. This typically reduces the number of new developments and slows property purchases, leading to supply constraints and higher prices in the long run. Conversely, government initiatives like affordable housing programs and mortgage support schemes attempt to counterbalance these effects by keeping homeownership accessible to the middle class. Additionally, fiscal policies such as reduced import taxes on construction materials can help manage inflationary pressures within the housing sector. Over time, consistent and transparent economic policies attract foreign investors who seek stable markets for long-term real estate ventures. Therefore, understanding the connection between economic policy and inflation helps both local and international investors navigate Kenya’s real estate with greater foresight and strategic planning.

Role of the Central Bank of Kenya

The Central Bank of Kenya (CBK) plays a pivotal role in controlling inflation and maintaining economic stability, which directly impacts real estate. By setting the base lending rate, the CBK influences how expensive it is to borrow money for construction and home purchases. Higher interest rates discourage borrowing, slowing the growth of new developments and lowering property sales volume. Conversely, when the CBK lowers rates, property demand typically increases, as financing becomes more affordable for both developers and individual buyers. This cyclical relationship shows how monetary policy can either stimulate or restrain the real estate sector depending on broader economic goals. Moreover, the CBK’s stability in maintaining inflation within the target range enhances investor confidence, attracting capital from both local and international markets. Investors who monitor these changes are better positioned to make timely decisions, whether in acquiring, holding, or selling property.

Fiscal Incentives for Developers and Investors

The Kenyan government has implemented fiscal incentives to promote real estate investment, including tax deductions, duty exemptions, and simplified approval processes. These measures encourage developers to undertake more projects even during inflationary periods when costs rise. By reducing operational expenses, the government makes it possible for developers to maintain affordable prices while sustaining profitability. Such incentives also create opportunities for foreign investors seeking reliable returns in emerging markets like Kenya. Furthermore, when construction materials are exempted from high import taxes, it reduces inflationary pressure within the sector, leading to more stable housing prices. These fiscal adjustments not only support economic recovery but also enhance the long-term sustainability of Kenya’s property market.

Construction Costs and Material Inflation

One of the most significant drivers of property price increases in Kenya is the inflation of construction materials. The cost of cement, steel, roofing sheets, and other building essentials has risen sharply due to global supply chain issues, currency depreciation, and higher import tariffs. This has created a ripple effect where developers face increased project costs, forcing them to raise sale prices to maintain profit margins. In many instances, ongoing projects have been delayed or scaled down as developers adjust to new market realities. Local suppliers, though benefiting from increased demand, often struggle to keep up with the cost of importing raw materials and meeting production capacity. These compounding factors make it increasingly difficult for the average Kenyan to afford a new home, particularly in urban areas. The government’s effort to encourage local manufacturing and reduce reliance on imports is a crucial long-term solution, but immediate relief remains limited. Ultimately, the rise in material costs underscores how deeply inflation is intertwined with property development and affordability across Kenya.

Effects on Developers and Construction Timelines

Developers in Kenya are facing unprecedented challenges due to soaring material costs and logistical bottlenecks. Projects that were initially budgeted under stable price conditions are now running over budget, forcing developers to either increase unit prices or absorb the losses. As a result, many construction companies are adopting phased development strategies to spread costs over time and minimise financial strain. Delays in project completion have also become more common, impacting supply and contributing to higher demand for existing properties. These adjustments reveal the delicate balance developers must maintain between profitability and affordability during inflationary cycles. Furthermore, some have turned to alternative materials and technologies—such as prefabricated panels and recycled resources—to manage costs and timelines effectively.

Impact on Homebuyers

For homebuyers, rising construction costs directly translate into higher purchase prices and reduced options in the market. Many potential homeowners are now turning to mortgage products or smaller housing units to manage their budgets. However, inflationary pressures often outpace wage growth, creating a widening gap between housing demand and purchasing power. This has also led to an increase in rental demand, as more people postpone property ownership. As construction costs remain volatile, homebuyers are encouraged to explore emerging towns where land and labor remain more affordable. These shifts highlight the broader socioeconomic impact of material inflation, which influences not only real estate prices but also the overall accessibility of homeownership in Kenya.

Investor Behavior During Inflationary Periods

Investor sentiment in Kenya’s real estate market changes significantly when inflation rises. While some investors view inflation as a threat to profitability, others see it as an opportunity to hedge against the depreciating value of money. Real estate is traditionally considered a strong inflation hedge because property values tend to rise along with prices of goods and services. However, this depends heavily on location, property type, and overall market demand. During inflationary periods, investors often shift focus toward land acquisition and rental properties that offer consistent income streams. Foreign investors, particularly from the diaspora, tend to capitalise on currency advantages, purchasing Kenyan properties at relatively lower costs. This influx of investment helps stabilise the market but can also lead to speculative price increases. Therefore, understanding investor psychology during inflation is essential for predicting market movements and anticipating demand surges in key regions.

Local vs. Foreign Investor Reactions

Local investors often take a cautious approach during inflationary spikes, prioritising asset preservation over aggressive expansion. Many focus on rental properties or land holdings that promise steady long-term returns. In contrast, foreign investors—especially those operating in stronger currencies—view inflation as a buying opportunity, as their purchasing power increases relative to the Kenyan Shilling. This dual behavior creates a layered market dynamic where foreign capital drives growth while local investment maintains stability. The result is a mixed market that remains active but increasingly segmented between high-end developments and affordable housing segments.

Real Estate as a Hedge Against Inflation

Property ownership remains one of the most effective ways to protect wealth during inflation. As the value of money decreases, tangible assets like land and buildings retain or even increase in value. In Kenya, this principle is especially evident in urban centers where population growth sustains long-term demand. Investors who purchase early during inflationary cycles often benefit the most, as property prices adjust upward while rental income also rises. Moreover, unlike stocks or bonds, real estate offers the added advantage of utility—properties can generate income or be developed further. This combination of value retention and functional use makes real estate one of the most stable investment options during inflation.

Government Interventions and Housing Stability

To address inflation’s impact on property prices, the Kenyan government has rolled out several policies aimed at stabilising the housing market. These include affordable housing programs, mortgage rate subsidies, and construction material tax exemptions. The Affordable Housing Program (AHP) under the Kenya Kwanza government continues to promote access to low-cost homes by encouraging partnerships between the public and private sectors. Furthermore, initiatives by the National Housing Corporation (NHC) have expanded opportunities for middle-income earners to acquire homes with flexible payment options. While these programs have shown progress, challenges such as bureaucratic delays, limited financing, and urban land shortages persist. However, these efforts have created a more structured environment where both developers and buyers can operate with greater confidence despite inflationary pressures.

Affordable Housing Projects

Affordable housing remains central to Kenya’s long-term vision for inclusive growth. Government-led initiatives like Boma Yangu have successfully enlisted thousands of Kenyans seeking affordable ownership options. By leveraging economies of scale and public-private partnerships, the government ensures more efficient delivery of housing units. However, to maintain momentum amid inflation, continuous funding and transparency are necessary to attract private developers. If managed effectively, these projects can serve as a buffer against inflation by stabilising supply and reducing speculative price hikes.

Policy Impact on Urban Development

Government policy also affects how urban spaces evolve under inflationary conditions. Cities like Nairobi, Mombasa, and Nakuru are expanding through mixed-use developments that combine residential, commercial, and recreational spaces. These developments help optimise land use and reduce commute times, enhancing property value sustainability. However, inflation-related cost pressures may slow the completion of major projects, especially those dependent on imported materials. Thus, maintaining supportive urban policies remains crucial in managing growth and affordability simultaneously.

Future Outlook: What to Expect Beyond 2025

Kenya’s real estate market shows resilience even as inflation persists, largely due to continuous urbanisation and infrastructure investments. Looking beyond 2025, the property market is expected to remain on an upward trajectory, supported by improved investor confidence, stronger policy frameworks, and rising population growth. While inflation will continue influencing property prices, the long-term trend points toward gradual stabilisation. Technological adoption, such as smart building systems and digital real estate platforms, is also expected to reshape how properties are bought and sold. Additionally, the integration of green building practices will become more mainstream, promoting sustainability and reducing operational costs over time. If Kenya maintains steady macroeconomic growth and government consistency in housing policy, the property sector will remain one of the country’s most promising investment areas. Investors, developers, and homeowners should, therefore, focus on long-term planning rather than short-term fluctuations when assessing market potential.

Emerging Investment Hotspots

New investment opportunities are emerging across Kenya, particularly in counties like Kajiado, Machakos, Nakuru, and Laikipia. These areas are benefiting from infrastructure projects such as road expansions and improved utilities. As urban sprawl continues, these satellite towns are becoming preferred alternatives for those priced out of major cities. Property values in these regions are expected to appreciate steadily, offering strong returns for early investors.

Long-Term Inflation Management

Kenya’s ability to manage inflation will determine how sustainable the real estate market remains. Consistent policy execution, increased local production of building materials, and enhanced monetary oversight are key to maintaining balance. With proper planning, the effects of inflation can be mitigated, leading to a stable, inclusive, and growth-oriented property market over the next decade.

Conclusion

Inflation significantly influences property prices in Kenya, affecting affordability, investment potential, and market stability. Understanding the relationship between inflation and property prices in Kenya allows buyers and investors to make informed decisions, mitigate risks, and capitalize on growth opportunities. Monitoring inflation trends, sector-specific price movements, and government initiatives is key to navigating the 2025 property market successfully.