Kenya Rental Market Trends 2026

Explore Kenya rental market trends in 2026 — including rental prices in Nairobi and satellite cities, rental yields in Kenya’s urban hubs, and housing demand shifts. Learn where to invest, what renters are paying, emerging hotspots, and expert insights to act now.

Introduction

What Kenya Rental Market Trends means for tenants & investors:

Kenya Rental Market Trends 2026

Kenya rental market trends in 2026 provide crucial insights for both tenants and property investors. Understanding these trends helps tenants identify affordable areas while guiding investors to high-yield opportunities in Nairobi, Mombasa, Nakuru, and emerging satellite towns.

Why 2026 is a pivotal year (economic shifts, evolving demand):

This year marks significant shifts in rental demand due to rising urbanization, infrastructure projects, and changes in income patterns. Rental prices and yields are adjusting to reflect economic pressures and growing population needs, making 2026 a critical year for strategic decisions in the real estate market.

Snapshot of rental price movements & yield performance:

Across Kenya, rental prices are seeing moderate growth in high-demand suburbs, while some premium areas are experiencing slight decreases. Rental yields are shifting, with smaller apartments and townhouses often delivering higher returns than luxury units. Tenants and investors alike must navigate these trends carefully to maximize value.

Quick Snapshot

- Average rent growth or decline year‑on‑year: Rents in Nairobi have increased by 5–8% in popular suburbs, while some premium estates show stable or declining rents.

- Top cities with highest demand: Nairobi, Mombasa, Nakuru, Kisumu, and Eldoret lead in rental demand due to urbanization and employment hubs.

- Approx. rental yields across market segments: Two-bedroom townhouses and small apartments offer yields of 7–9%, while luxury apartments typically yield 4–6%.

Kenya Rental Market Trends — National Overview

Key Market Indicators for 2026

The Kenya rental market trends in 2026 are shaped by several key indicators, including urban population growth, economic recovery patterns, and the ongoing expansion of residential and commercial developments. Vacancy rates in major cities have slightly declined, signaling strong rental demand, while the average rent-to-income ratio highlights affordability challenges for middle-income households. Investors and tenants can use these indicators to identify opportunities or make informed renting decisions.

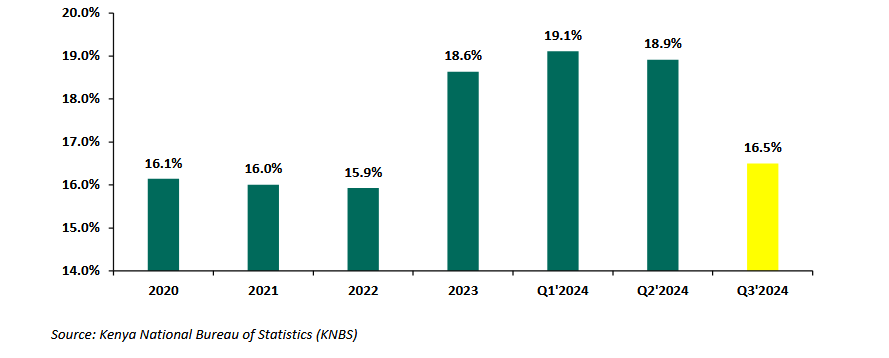

Comparison With 2024 Performance

When compared with 2024, Kenya’s rental prices have shown moderate growth in high-demand areas such as Nairobi’s Westlands and Kilimani, while some luxury suburbs experienced slight declines. Overall, rental yields remain stable, particularly for small to mid-sized apartments, reflecting a balance between rising demand and controlled supply. Tracking these yearly changes allows investors to assess long-term profitability and tenants to plan for rental affordability.

Policy & Infrastructure Impact on Rental Markets

Government policies, such as housing incentives and rent regulation measures, continue to influence rental market dynamics across Kenya. Additionally, infrastructure developments like new roads, commuter rail expansions, and urban service projects have increased demand in satellite towns, affecting rental prices and yields. Investors and tenants monitoring these policy and infrastructure trends can anticipate which areas are likely to see future growth or rental stability.

Rental Prices in Nairobi & Satellite Towns

H3: Nairobi Core Market — Price Trends

Rental prices in Nairobi’s core market continue to vary by suburb, property type, and unit size. Middle-income areas like Parklands and Kilimani have seen moderate increases, while premium areas such as Runda and Karen show slower growth or minor declines. Factors like proximity to business districts, schools, and amenities remain key drivers of rent levels, influencing where tenants choose to live and investors focus their property acquisitions.

Satellite Towns & Suburban Price Movements

Satellite towns such as Ruiru, Syokimau, Kitengela, and Ruaka are experiencing rising rental demand due to more affordable housing, improved commuter links, and expanding commercial hubs. While some suburbs see rapid price growth, others remain competitively priced, creating opportunities for tenants seeking value and investors pursuing high-yield properties. These trends demonstrate a clear shift as affordability and accessibility drive rental demand beyond Nairobi’s core.

Rental Price Variations by Property Type

Different property types in Nairobi and surrounding towns show varying rental performance. Two-bedroom townhouses and small apartments tend to offer the most attractive yields, while luxury apartments and large houses have lower relative returns due to higher purchase prices and slower tenant turnover. Understanding these variations helps both tenants identify suitable rentals and investors choose profitable property types.

Rental Yields in Kenya’s Urban Markets

How Rental Yields Are Calculated

Rental yields in Kenya are calculated by dividing the annual rental income of a property by its purchase price, then multiplying by 100 to get a percentage. This metric helps investors evaluate potential returns and compare different property types or locations. Understanding how yields are calculated allows investors to identify properties that offer the best balance between price, demand, and income potential.

Top Yield Cities: Nairobi, Mombasa, Nakuru, Eldoret

In 2025, the top cities delivering strong rental yields include Nairobi, Mombasa, Nakuru, and Eldoret. Nairobi remains a high-demand urban hub, while Mombasa’s coastal rentals attract long-term tenants. Nakuru and Eldoret are emerging investment hotspots due to growing urbanisation and relatively lower property prices. Tracking yields across these cities enables investors to focus on areas offering the highest return on investment.

Best Property Types for Yields in 2026

Two-bedroom townhouses and smaller apartments generally deliver higher rental yields than studios, bedsitters, or large luxury units. These property types attract a wider tenant base, maintain high occupancy, and offer better returns relative to their purchase prices. Investors focusing on such property types can achieve consistent cash flow and long-term rental performance.

Housing Demand Drivers Across Cities

Urbanisation and Population Growth Impact

Rapid urbanisation and population growth continue to drive housing demand in Kenya’s major cities. Cities like Nairobi, Mombasa, and Nakuru are seeing increased rental requirements as rural-to-urban migration rises. High population growth in urban centers pushes demand for affordable and mid-range rental units, shaping rental market trends for tenants and investors alike.

Income & Affordability Trends

Income levels and housing affordability are key determinants of rental demand in Kenyan cities. Middle-income households are increasingly seeking smaller apartments or townhouses due to rising rents in premium areas. Affordability pressures influence both tenant choices and investor decisions, highlighting the importance of aligning property offerings with market realities.

Sectoral Demand — Residential vs Commercial Rentals

Demand patterns vary significantly between residential and commercial rentals. Residential rentals, particularly apartments and townhouses, remain dominant in most urban areas, while commercial rentals grow in areas with business expansion and infrastructure projects. Understanding these sectoral differences allows investors to balance their portfolio between steady residential income and higher-risk, potentially higher-return commercial rentals.

Rental Market Segment Trends

Residential Rentals — Flats, Houses & Apartments

Residential rentals in Kenya remain the largest segment of the rental market, with flats, apartments, and standalone houses dominating urban areas. Flats and two-bedroom apartments are particularly popular among young professionals and middle-income families, while standalone houses cater to high-income tenants. Tracking these residential rental trends helps investors identify areas with steady demand and high occupancy rates.

Commercial & Retail Rental Trends

Commercial and retail rentals are influenced by business growth, office demand, and retail expansion in urban centers. Prime locations in Nairobi and Mombasa command higher rents, while emerging suburban commercial areas are gaining traction due to lower costs and growing local populations. Investors looking to diversify can explore these trends for potential high-yield opportunities outside the residential market.

Industrial & Warehouse Rental Dynamics

Industrial rentals are expanding rapidly in Kenya, driven by e-commerce growth, logistics demand, and the need for warehouse space near major transport corridors. Cities like Nairobi, Mombasa, and Naivasha are seeing increased rental rates for warehouses and storage facilities. Investors and tenants must monitor industrial rental dynamics to capitalize on this growing segment.

Investment & Rental Opportunities

Best Cities for Buy-to-Let Investments

The best cities for buy-to-let investments in Kenya include Nairobi, Mombasa, Nakuru, and Eldoret. Nairobi remains the most lucrative due to high demand and stable rental yields, while secondary cities like Nakuru and Eldoret offer lower entry costs and strong growth potential. Investors can maximize returns by analyzing rental yields and occupancy trends in these urban centers.

High-Growth Suburbs & Emerging Hotspots

Suburbs such as Ruiru, Syokimau, Kitengela, and Ruaka are emerging as high-growth rental hotspots due to affordability, improved transport links, and proximity to employment hubs. These areas attract tenants seeking value and offer investors opportunities for higher rental yields compared to established city centers. Monitoring emerging suburbs is essential for strategic rental property investment.

Rental Yield Maximization Tips

To maximize rental yields, investors should focus on property types with high occupancy potential, maintain competitive pricing, and ensure property amenities meet tenant expectations. Regular maintenance, professional management, and market research are also key strategies to increase returns. These measures help investors optimize cash flow and long-term profitability in Kenya’s rental market.

Conclusion

The Kenya rental market trends in 2026 highlight a dynamic landscape for both tenants and investors. Rental prices are gradually increasing in middle-income areas, rental yields remain strong in top cities, and housing demand is shifting toward satellite towns and smaller, more affordable units. Investors and renters should monitor urbanization patterns, infrastructure projects, and emerging suburbs to make informed decisions.